Investing in energy companies has always been a popular choice for many investors looking to diversify their portfolios. One such company that has caught the attention of investors lately is Kaycee Energy. In this article, we will conduct a thorough analysis of Kaycee Energy’s share price and provide a forecast for its future performance.

Introduction to Kaycee Energy

Kaycee Energy is a prominent player in the energy sector, specializing in oil and gas exploration and production. The company operates in various regions globally, with a strong focus on efficient operations and sustainable growth. With a proven track record of delivering results, Kaycee Energy has garnered significant attention from both individual and institutional investors.

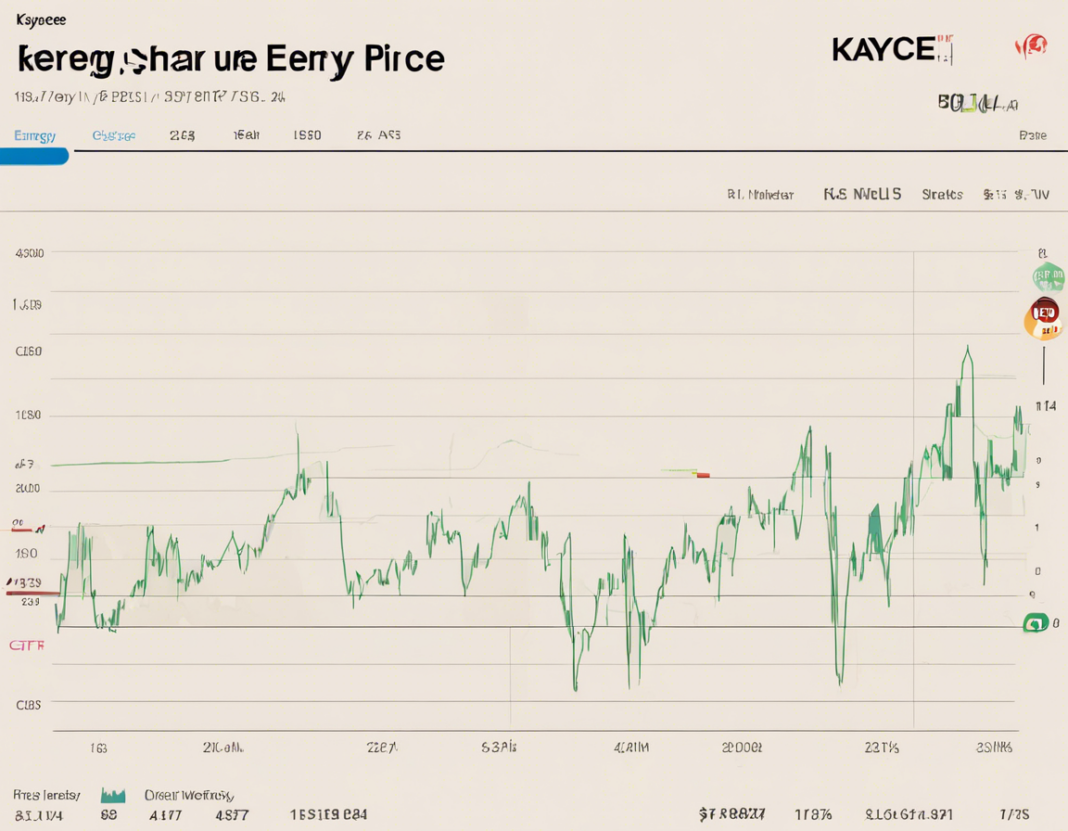

Share Price Performance

The share price of Kaycee Energy has exhibited notable volatility in recent months, influenced by various factors such as global economic conditions, geopolitical events, and industry-specific trends. Despite this volatility, the company has managed to maintain a relatively stable share price, reflecting investor confidence in its long-term prospects.

Factors Influencing Share Price

Several factors can impact Kaycee Energy’s share price, including:

-

Oil and Gas Prices: The prices of oil and gas have a direct impact on Kaycee Energy’s profitability, as they influence the company’s revenue and earnings.

-

Regulatory Environment: Changes in regulations related to the energy sector can affect Kaycee Energy’s operations and financial performance, thereby influencing its share price.

-

Competition: The competitive landscape in the energy sector can impact Kaycee Energy’s market share and profitability, which in turn can affect its share price.

Financial Performance

Kaycee Energy’s financial performance is a key indicator of its overall health and stability. Investors closely monitor metrics such as revenue, earnings, and cash flow to assess the company’s ability to generate returns and sustain growth.

Key Financial Metrics

-

Revenue Growth: Kaycee Energy’s revenue growth rate is a crucial metric that indicates the company’s ability to increase sales over time.

-

Earnings Per Share (EPS): EPS measures Kaycee Energy’s profitability on a per-share basis, providing insight into its operational efficiency.

-

Cash Flow: Positive cash flow is essential for Kaycee Energy to fund its operations, invest in growth opportunities, and reward shareholders through dividends or share buybacks.

Forecast and Outlook

While predicting the share price of any company with absolute certainty is challenging, analysts and investors rely on various forecasting models and fundamental analysis to estimate future performance.

Future Prospects

Based on the company’s solid fundamentals, strong market position, and strategic initiatives, many analysts are optimistic about Kaycee Energy’s future prospects. Potential catalysts such as new discoveries, technological advancements, and favorable industry trends could drive the company’s share price higher in the coming years.

Risks and Challenges

However, it is essential to acknowledge the risks and challenges that could impact Kaycee Energy’s share price. Factors such as fluctuating commodity prices, geopolitical instability, and regulatory changes could pose significant challenges to the company’s growth and profitability.

Frequently Asked Questions (FAQs)

Q: Is Kaycee Energy a good investment option?

A: Kaycee Energy can be a suitable investment option for investors seeking exposure to the energy sector. However, like any investment, it is essential to conduct thorough research and assess your risk tolerance before investing.

Q: What factors should I consider before investing in Kaycee Energy?

A: Before investing in Kaycee Energy, consider factors such as the company’s financial performance, industry trends, competitive position, and overall market conditions.

Q: Does Kaycee Energy pay dividends to its shareholders?

A: Kaycee Energy may pay dividends to its shareholders, depending on its financial performance and capital allocation priorities.

Q: How does Kaycee Energy’s share price react to changes in oil prices?

A: Kaycee Energy’s share price is closely correlated with changes in oil prices, as they directly impact the company’s revenue and profitability.

Q: What are some of the risks associated with investing in Kaycee Energy?

A: Risks associated with investing in Kaycee Energy include commodity price volatility, regulatory changes, operational risks, and competitive pressures.

In conclusion, Kaycee Energy presents an intriguing investment opportunity for those interested in the energy sector. By conducting a comprehensive analysis of the company’s share price performance, financial health, and future prospects, investors can make informed decisions about including Kaycee Energy in their portfolios. Remember to consider the risks and challenges involved and stay updated on industry developments to maximize investment returns.